FASB ASC Topic 842, Leases – What You Need to Know About the Incremental Borrowing Rate

One of the hot topics in the accounting world is the implementation of Accounting Standards Codification (ASC) Topic 842, Leases, which replaces ASC Topic 840 and is published by the Financial Accounting Standards Board (FASB).

Under the new rules, public companies are required to adopt this new standard for annual reporting periods beginning after December 15, 2018, with private entities adopting the standard one year later. The main effect of ASC Topic 842 is to require companies to capitalize all operating lease obligations that exceed 12 months, and book a corresponding lease liability. Both the capitalized asset (the Right of Use Asset) and the liability involve present valuing the future lease payments using an appropriate discount rate, in most cases the incremental borrowing rate (IBR). Technically, a company should rely on the interest rate implicit in the lease to determine the appropriate discount rate. However, this rate is generally indeterminable and requires knowledge of the fair value of the leased asset. In practical terms, companies will almost always rely on their IBR. As a result, the selected IBR can have a significant impact on a company’s balance sheet.

What Is the IBR?

ASC Topic 842 defines the IBR as:

The rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.

Under the old rules (ASC Topic 840), the IBR corresponded to the rate associated with financing the purchase of the leased asset. The definition did not specify that the rate had to be secured and it took into account property-specific considerations. Generally, the definition of IBR under ASC Topic 842 results in a lower discount rate than under ASC Topic 840.

Below are the characteristics of the IBR:

- Collateralized – Whereas the old definition did not specify whether the discount rate needed to reflect collateralization, the new definition specifies a secured rate, which reflects full collateralization, but not over- or under-collateralization. For this hypothetical borrowing, the lessee could use as collateral any asset it holds that is at least as liquid as the underlying asset. Since the lessee does not own the underlying asset, it could not use that asset as collateral.

- Similar term – The term associated with the hypothetical borrowing and IBR should correspond to a period comparable to the lease term.

- Similar economic environment – To the extent that market indications obtained by a hypothetical company (the Company) reflect loans initiated as of a different date than the measurement date, or the lease was executed in a foreign country, the Company will need to make adjustments to the obtained rate to calculate the applicable IBR.

Key Steps in Determining the IBR:

- Start with the Company’s existing debt facilities.

- If the Company has a secured line of credit, it may serve as an indication for the Company’s IBR. However, the Company should consider whether adjustments need to be made for any changes in the economic environment or to reflect the appropriate amount of collateralization.

- If the Company has an unsecured loan, start with the interest rate and adjust downward to obtain a secured rate. Also, adjust for any changes in the economic environment or term.

- 2. If the Company does not have any comparable debt facilities, the Company must look to market indications.

a. Unless comparable secured rates are available, start with a general, unsecured recourse borrowing rate for loans with:

- A similar term;

- Initiated in a similar interest rate environment;

- Located in a similar geography; and

- Reflecting the Company’s credit rating.

b. Adjust the rate for effects of full collateralization.

Paragraph 842-20-30-3 of ASC Topic 842 provides a practical expedient for private companies, which allows them to use a risk-free rate, rather than an IBR, to calculate the Right of Use Asset and lease liability. Since the risk-free rate is lower than the IBR, this expedient would result in higher values for both the asset and liability. For public companies, the selection of an appropriate IBR for a Company can also have a significant impact on its balance sheet.

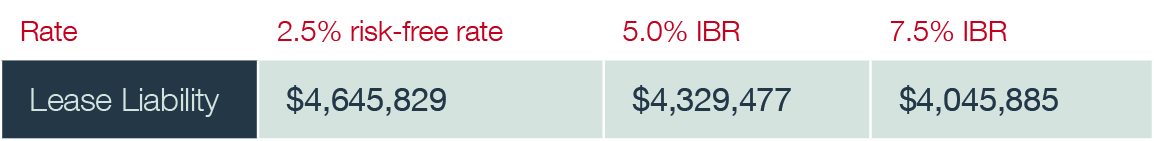

Below is an example related to quantifying the lease liability using three different rates. Note that the calculation of the Right of Use Asset starts with the value of the liability and makes certain modifications for prepayments, direct costs and/or lease incentives. Assuming a five-year lease with annual lease payments of $1 million, the implied lease liability would be as follows:

In this example, the difference between using a 5.0% and a 7.5% IBR can result in a $284,000 difference in the liability.

The Takeaway

Companies should work closely with their auditors to ensure that they are properly implementing the new lease standard, and in many cases will need to employ third-party valuation or other specialists to help them determine their company’s IBR. Additionally, companies will also need to work with their tax advisors; although ASC Topic 842 will not impact how leases are treated for U.S. federal income tax purposes, it may impact U.S. tax accounting methods, deferred tax accounting, and state taxes, among other areas.