International Executives

Andersen provides comprehensive solutions to complex international tax and wealth issues facing today’s increasing population of global executives. We take an integrated approach to tax planning and consider not just your individual tax situation, but the impact of all your financials interests so that your tax services are coordinated with an awareness of your total tax and financial posture – on a global basis. Our advisors assist you in maximizing your wealth by focusing on minimizing your effective global tax rate.

Clients choose us because we provide cost-saving opportunities enabling them to manage their tax affairs more efficiently. We provide peace of mind because our clients understand our commitment to maximizing their wealth while minimizing risk and exposure.

We can assist employers and executives with:

- Tax planning for U.S. inbound and outbound (expatriate) executives

- Domestic and host country tax compliance

- Comprehensive and integrated expatriate tax planning

- Comprehensive and integrated financial counseling

- Payroll and compensation matters for employers and expatriate employees

- Planning for departure/expatriation from the U.S. (i.e., relinquishing green card or citizenship)

- Assistance and representation with tax audits and disputes with tax authorities

Managing Directors

-

David Roberts

New York, NY

-

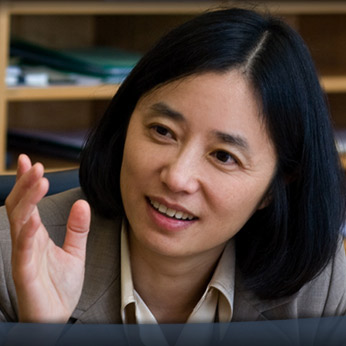

Yichen Shepard

San Francisco, CA

-

web page

International Executives